Real Estate Legal Guide & Laws

Shop The Rent Agreement Template Online With Documents and Benefits

A shop rent agreement is a pivotal document that outlines the terms and conditions between a landlord and a tenant for the rental of commercial property. It delineates the responsibilities

January 31, 2025 by Priyanka Saha

GST on Commercial Property: Rates, Compliance, and Tax Benefits

January 31, 2025 by Priyanka Saha

Explore all blogs

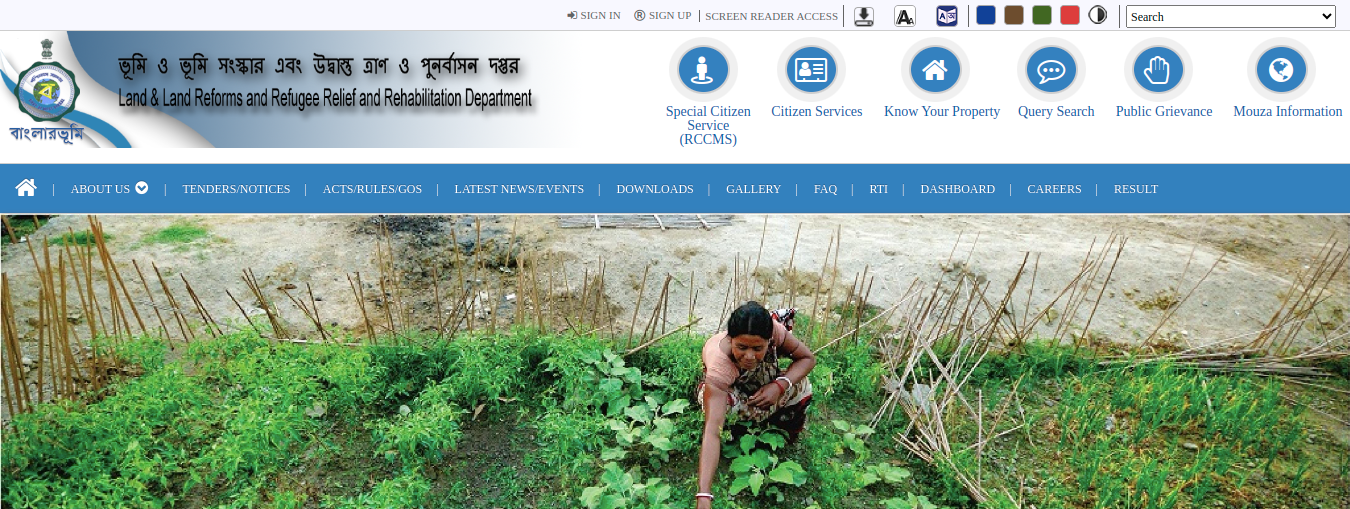

Banglarbhumi West Bengal Land Records and Khatian: Online/Offline Registration, Track Status and Mouza 2025

Banglarbhumi, also known as Banglarbhumi, is an online website portal to access the West Bengal land records. This initiative by the government of West Bengal is taken to make the citizens more accessible to any information related to land. The Banglarbhumi government website offers infor

Written by Kruthi

Published on January 31, 2025

Importance and How to Apply for a Legal Heir Certificate in Delhi

Losing a loved one is a difficult experience, but life goes on, and there may be legal and financial matters that require attention. A Legal Heir Certificate in Delhi is a crucial document that serves as official verification of inheritance rights. This certificate simplifies the process

Written by Kruthi

Published on January 31, 2025

NoBroker Rent Agreement

Rental Agreements continue to be an unresolved pain point, whether you are a tenant or a homeowner. The main trouble with a rental agreement is the learning curve involved in it.

Written by Simon Ghosh

Published on January 31, 2025

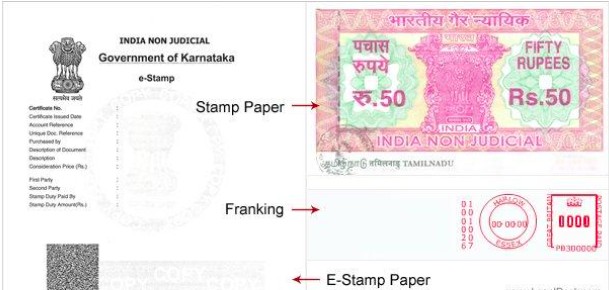

A Comprehensive Guide to E Stamp and E Stamping Process

You must pay stamp duty to national or state authorities to purchase, sell, produce a deed, or even rent your property. Electronic stamping, often known as e-stamping, is a technique of electronically paying government non-judicial stamp tax. Previously,

Written by Kiran K S

Published on January 31, 2025

Property Tax in Faridabad: Online Payment, Calculator & Expert Guide in 2025

Property Tax in Faridabad is a mandatory tax paid by property owners to the Municipal Corporation Faridabad (MCF). It is paid for residential, commercial, and industrial properties to maintain public services like street lights, roads, drainage systems, government schools, hospitals, and

Written by Anda Warner

Published on January 31, 2025

All you need to know about Home Demolition in India

Home demolition is a complex and sensitive topic in India, as it can have significant impacts on the safety, cost, and legality of a property. Individuals and communities need to understand the process of home demolition, including the cost to demolish a house, safety measures for the dem

Written by Anda Warner

Published on January 31, 2025

Get Your Environment Clearance For Construction Projects

Regarding construction projects, environmental clearance is one of the most important things to consider. This is because, in many cities, construction projects must go ahead with proper environmental clearance. Construction proje

Written by Vivek Mishra

Published on January 31, 2025

The Legal Implications Of The Difference Between Ancestral Property And Inherited Property In India

Indian property laws can be confusing for many people, especially when it comes to ancestral and inherited property. This blog will help you understand the differences between these two types of property, their legal and tax implications, and how you can protect your rights as a property

Written by Siri Hegde K

Published on January 31, 2025