Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

Franking Charges Explained: Meaning and Benefits

Table of Contents

Buying your dream home involves a lot of research regarding locality, weather, accessibility and interiors. What is also of utmost importance but usually gets overlooked is the financial aspect of buying property. There are numerous small and big payments that can increase the price of the property significantly. Conversations with the seller may have introduced the terms Registration Charges, Stamp Duty, Loan Processing charges, Technical Appraisal charges, Franking charges and so on. It is important to understand what these charges mean to avoid any defaults and ensure a smooth home buying experience.

What is Franking Charges?

When buying property, you need to pay a tax to the government to make the purchase legal, called stamp duty. An extra charge related to stamp duty that most buyers don’t know about is the franking charge. Stamp duty and franking charges are often confused to be the same thing. The reason for this confusion is mainly because these two charges are usually incurred at the same time. However, they are separate charges and, in this article, we will discuss franking charges meaning as well as franking meaning.

Read: Form 16 – Why Is It Important for Your Income Tax Returns

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

What is Franking?

Franking is nothing but an agreement franking. It is a seal that indicates payment of stamp duty is done. So, Franking is the process to get property documents stamped.

Franking is provided by authorised institutions or agencies such as banks, to prove the legality of the document, we can take help of such institutions to affix a stamp or a denomination on the document.

To get the Franking done a Franking machines is installed in sub-registrar offices of different states in India.

Benefits of Franking

There are several benefits of using a franking machine instead of stamps. These include:

- Reduced Costs: Franked mail costs less to send than stamped mail, as you only need to purchase postage once rather than for every letter or parcel. This can save you a lot of money in the long run.

- Convenience: With a franking machine, you can quickly and easily prepare your mail for dispatch without having to go to the post office. This saves you time and energy, which can be precious commodities sometimes!

- Efficiency: A well-maintained franking machine will produce clean, consistent impressions every time. This makes it easier for postal workers to identify and sort your mail correctly, ensuring that it reaches its destination as quickly as possible.

Why Franking Was Introduced?

Previously, confirmation of payment of stamp duty was done by printing the agreement on non-judicial stamp papers. This process, however, led to forgery, misuse and stamp paper scams and had to be stopped by the government.

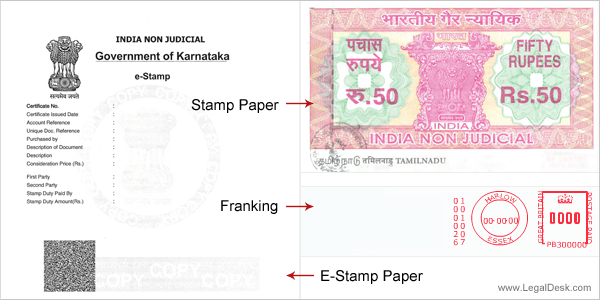

Difference Between Stamp Duty and Franking Charge

While franking paperwork or franking paper refers to the practice of having these legal property papers stamped, stamp duty is the tax you pay to the government for authorising the property transaction.

A government charge known as stamp duty is applied to real estate documents like sale deeds and transfers of assets and properties. Depending on the state, it ranges from 4 to 6 percent. It can be paid in person or online through the state portal at the sub-registrar's office.

It can be paid in person or online through the state portal at the sub-registrar's office.

Franking fee is a small fee that is required to be paid to the authorised bank or agent to have the denomination on the agreement document stamped or otherwise attached. Franking stamp paper typically doesn't cost anything, but banks have the right to charge up to 0.1 percent of the transaction value; these fees can be deducted from the amount of stamp duty that was paid. Only authorised banks are permitted to frank stamp paper, and even then, they are only permitted to frank for a certain number of hours each business day.

What is Stamp Duty?

Legal documents, including documents such as sale deeds, entailing the transfer of assets or properties, power of attorney agreements, conveyance deeds and other business agreements, are required to be stamped to ascertain their legal validity and binding. Stamp Duty is a government tax levied on such documents. We can consider it as a transaction tax that validates the registration of the property in your name and legalizes your ownership of the property. It is one of the major revenue generation sources for the government. Stamp duty is payable by purchasing pre-embossed stamp papers, by using e-stamp papers or by franking of stamps.

Franking Process in Banks

After all the required matter is typed on a plain sheet of paper, franking needs to be done at this point, before signing the documents. You, or the seller, must fill in an application with the details of franking in order to approach the concerned authority.

Not all banks are authorised to frank and accept stamp duty. The banks which are authorised will nevertheless have a fixed daily quota and can only frank a certain number of documents in a day. It is important that you approach the bank during the early hours of operations or through an authorised agent. Franking requires prior preparation from the authorities’ side and thus prior appointment with the concerned authority is suggested.

The bank through which you are availing of the home loan will provide you with exact information and agents regarding specific details.

Franking Charges

Compensation needs to be paid to the authority franking your documents, such as banks and agents. This amount is regulated by state governments and the amount varies between states. Certain states have a flat fee regardless of property value. However, most states levy a fee at 0.1% of the total sale value of the property or the loan amount. Because of the close relationship between franking charges and stamp duty, usually, the stamp duty is adjusted to include franking and the franking charges are deducted from stamp duty.

Following are the Franking Charges Statewise in India:

- Franking Charges in Maharashtra: 0.1%

- Franking Charges in Telangana : 0.1%

For example, if you are buying a property worth Rs. 80 lakhs, you will have to pay Rs. 8000 on top of it as a franking charge. Now, if the stamp duty in your state is 5.5% of the property value, you will only have to pay 5.4% as stamp duty if the franking charge has been paid. If you use other means of stamp duty payment, this adjustment shall not be made. (The stamp duty rates vary across states and are subject to change, the numbers used here are merely examples.)

It is important to note that stamp duty and franking charges are usually not covered by most home loans, so be prepared in this regard and keep this in mind while selecting a home loan vendor.

Franking Charges on Loan Agreements

Franking is usually done for loan agreements also, which typically falls somewhere around 0.1% on the loan agreement, as well as over and above the charges of the property document. This is done because franking helps prove the legality of your documents, essentially taking the authentication of your documents to be at least 0.2% of the loan agreement.

Franking of Documents

Franking a document requires you to print the agreement on plain white paper. Before the agreement is executed or the papers are signed, you will need to take the same to a franking agency or an authorised bank where they give you an application form, you pay a stamp duty fee, and get a stamp on the document affixed so that the amount of the stamp duty paid is reflected.

Calculation of Franking Charges

The franking fees differ between states. As a result, franking fees in Telangana are different from those in Maharashtra. It typically amounts to 0.1 per cent of the purchasing price. For instance, if you spent Rs. 40 lakhs on a property, the franking charge will be Rs. 4,000. Also keep in mind that the stamp duty fees include the franking stamp fee. You would therefore have to pay 6.4 percent at the sub-office registrar's and the remaining to the franking authority if the applicable stamp duty in your state is 6.5 per cent.

Pros and Cons of Franking

As mentioned above, there are other methods of paying stamp duty other than franking, viz. Pre-embossed stamp papers and e-stamping. All these methods come with their pros and cons.

Pre-embossed stamp papers are difficult to procure for all denominations and need to be bought from an authorised vendor and have additional costs. Verifying the authenticity of the vendor can be difficult and may lead to fraud cases.

And E-stamp paper is much more secure and safer compared to pre-embossed papers. If the internet services in your locality are good then this method is fast. However, cancelling an e-stamp paper is tiresome and may lead to losses in such cases.

Online Franking procedures are safe, fast and easy, especially if the payment is made through cash or demand draft. However, the problems with franking papers or even franking stamp papers, as mentioned in this article, are that the regulations and charges are not uniform across states, and avoiding delays caused by the quota limit for franking requires preparation and knowledge from your side.

Alternatives to Franking of Documents

One of the most popular ways to pay stamp duty to the government is through franking. Other methods of payment include buying stamp paper that has been previously embossed or using an electronic stamp.

It could be challenging to find pre-embossed stamp paper from authorised institutions and merchants for all denominations. Additionally, it is laborious for the average person to verify the legitimacy of the stamped paper.

As a result, e-stamping on online franking has gained popularity because it is a more dependable and secure way to pay stamp duty. Using internet banking, the transaction can be completed with ease online. For the purpose of paying stamp duty, those without activated online net banking may use a bank challan.

Franking is only advised when cash or a demand draft is used to make the payment. States have different franking laws, thus they are not all the same. Furthermore, quota restrictions cause problems for the buyer as well.

Future of Franking in India

Increasingly after the pandemic taking physical papers to the digital realm, more states have been adopting the process of franking online or e-stamping. This is because franking can soon be completely replaced with e-stamping due to the convenience and ease of access it offers to all.

Before planning on buying your dream home, it is very crucial to understand the overhead costs such as Franking charges so that you can plan your finances optimally and make decisions accordingly. You can start your home search on NoBroker by clicking below.

Recommended Reading

Sales Agreement: Process, Format and More 2025

January 31, 2025

21600+ views

Transfer of Property Act: Meaning, Types and Laws

January 31, 2025

4903+ views

Movable and Immovable Property: Understanding Legal Distinctions

January 31, 2025

48591+ views

Fractional Ownership and How It Is Affecting the Commercial Real Estate World

January 31, 2025

4900+ views

Joint Development Agreement in Indian Real Estate - A Guide

January 31, 2025

18079+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1096541+ views

Sales Agreement: Process, Format and More 2025

January 31, 2025

21600+ views

Leave and License Agreement: Legal Aspect and Format

January 31, 2025

19437+ views

Khata Certificate in Bangalore: The Essential Document for Real Estate Transactions

January 31, 2025

18730+ views

What is a Resale Property: Steps to Follow While Buying a Resale Flat?

January 31, 2025

14706+ views

Recent blogs in

How to Pay Property Tax Online in Hyderabad: Step-by-Step Process for 2025

March 25, 2025 by NoBroker.com

How to pay BBMP property tax online and offline, view the bill, and download the receipt in 2025?

March 25, 2025 by NoBroker.com

Renting a New House? Here’s a List of Things to Check

January 31, 2025 by NoBroker.com

Sales Agreement: Process, Format and More 2025

January 31, 2025 by Vivek Mishra

Join the conversation!